Opening up Product Data!

Two weeks ago, together with our friends at Provenance and Hub Westminster, we organised a two part event to discuss the what, why and how of opening up product data. The seeds for this event were sown months back when we started thinking about the diversity of stakeholders thinking about and hacking around the problem of closed product data. This diversity of stakeholders has also meant a diversity of approaches and we wanted to find out more about what others were doing, the challenges they were facing and the progress they had made. Ultimately we decided that we would all might benefit from getting together in the same room to collectively start working through some of our shared issues and collectively build the largest open product database in the world.

In a series of blog posts, I will recount what we discussed, the conclusions we reached ,whats left to be done (Spolier Alert: a lot) and how you can get involved!

The Event

We invited people from different sectors, with different backgrounds and skill-sets, who were approaching the problem of closed product data in different ways to come together for 12 hours and discuss Open Product Data and the Future of Retail. In the end, 150+ people took time out on a Thursday to do just that. The event was always intended to be a scoping event, to help us map out the best path forward. The event kicked off Thursday morning at 10am with speakers like Chris Taggart from OpenCorporates, Monika Solanki a researcher from Aston Business School and Vald Trifa from Evrythng. Video of the talks are coming soon but for now, if you want to know more about what they talked about see our collective notes here: Open Product Data Event Notes

The Groups

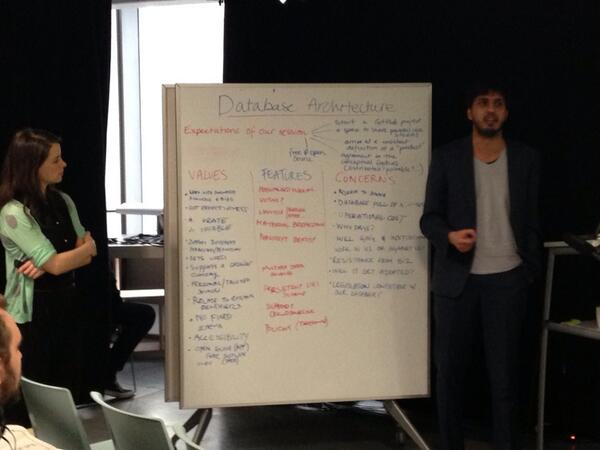

After the talks, we broke up into three groups where we discussed the data source possibilities, the database architecture and the future implications of Open Product Data. Equipped with flipboards, markers, post-its and our experience, we collectively worked through the challenges, opportunities and the innovative potential of a more open product data environment.

I lead the Data Source Possibilities group; here is what we discussed!

Data Source Possibilities: What data are we going to use to populate the worlds largest, collectively built, open product database, who owns this data and what are the incentives to keeping it closed and/or opening it up? – A small task for three hours!

After a short coffee break to digest the problem, we tucked in. When it comes to open data, products are pretty much an unmapped territory. Within minutes, only going through the obvious datasource possibilities like product specs and company ownership, we had come up with quite a daunting list. We decided to step back and approach the problem in a different way – who wins and who loses in the current product data ecosystem and how would this change if this were to open up product data? Immediately there were some obvious winners and losers. Consumers lose out because lack of transparency has lead to perverse incentives for cost cutting and the institutions that benefit the most from the closed data ecosystem are the institutions whose business model is built around selling product data. No surprises here.

However, data brokers and consumers are only a few of the stakeholders involved in any given products lifecycle and the incentives and/or disincentives to opening up for manufactures, distributers, retailers etc. are more complex. For example, one might assume that small artisanal makers would benefit from open product data and supply chain transparency in order to more easily showcase their production process. In reality, their process – from where they source their materials to how they make their products – is often something that small artisanal producers are very protective over as this process is their IP. The knowledge and relationships they have built over years is something they may be concerned about making public. Similarly, large multinationals who one might assume benefit from the secretive nature of an closed product data ecosystem might actually benefit from opening up, to a certain extent at least. The secrecy around how products are made has eroded trust and market leaders, wishing to distance themselves and their brand from the bad press associated with disasters like the garment factor collapse in Bangladesh, sweatshops and child labour abuses, might need to open up for anyone to believe them.

Ultimately we concluded that for the majority of product data owners and producers, there are both incentives and disincentives for opening up. Rocking the boat is always intimidating for companies thriving under the status quo but the tides are shifting and moving towards more transparency and open data in the product space is inevitable. Who will be the early adopters is still unknown but we will continue to push data owners to join the revolution. In the next in this Open Product Data blog series I will talk about the conclusions reached by other working groups and the evening event we held!

We are hoping to continue what we started with small events every few months in London. If you are interested get in touch! If you have ideas for the open product database, want to contribute or just want to find out more, you can join the Open Product Data working group on our mailing list or contribute on Github.

Join us in building the largest open product database in the world – together we can shape the new consumer experience.

Open Product Data

Open Product Data